Unlock the Power of Infinite Banking with

Your Own Personal Private Bank

“Don’t Do What Banks Say…Do What They Do!”

Reimagine how you grow, access, and control your wealth without relying on traditional banks.

Infinite Banking is a powerful financial strategy that uses overfunded permanent life insurance contracts - specifically, dividend-paying whole life policies—to help you take back control of your money.

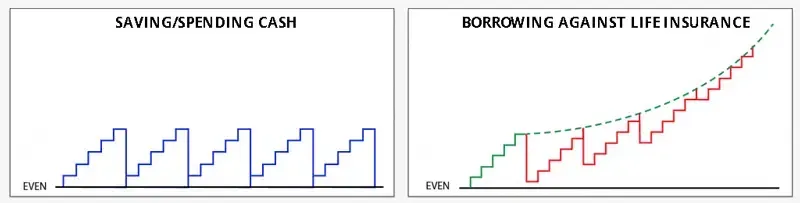

Instead of saving, spending, and replenishing cash in banks, IBC (the infinite banking concept) involves overfunding a Whole Life policy designed with custom riders and then borrowing against its continuously compounding cash value.

Instead of depending on external lenders or volatile markets, this approach allows you to become your own banker, building a private, tax-advantaged financial system that works in your favor.

By intentionally overfunding a properly structured whole life insurance policy, you create a high-cash-value asset that grows predictably over time, earns uninterrupted compounding interest, and gives you liquid access to capital without interrupting its growth. That means you can finance major purchases, invest in opportunities, or cover emergencies using your own money, while it continues to grow in the background.

Funneling cash flows through an infinite banking system rather than traditional banks will provide these lifelong benefits:

Guaranteed growth every single day

Lifelong tax-sheltering & tax-free access

A hedge against death, disability, and lawsuits

BIG ONE - Continual cash value compounding even when borrowing

Seed Your Infinite Banking With Reserves

Just like a bank must seed its balance sheet with reserves to lend against, you must fund your customized Whole Life policy with premium payments.

Normally, people think of any kind of insurance payment as being just another bill where money will be leaving their pocket, never to return again unless something bad happens. This is NOT the case with infinite banking life insurance, it's more like a deposit where you can borrow against your cash value anytime after the first 30 days for emergencies or opportunities.

Special Sections

The Infinite Banking concept and strategy works well for anyone, but is especially advantageous for Real Estate Investors, Business Investors and Business Owners. We have the following special sections dedicated to these two groups:

Real Estate Funding with Overfunded Permanent Whole Life Contracts

Business Owner strategies using the Privatized Banking Concept

Resources

We have several guides and articles regarding privatized banking, strategies and publications.

1. Privatized Banking: Using Overfunded Permanent Insurance Contracts for High Income Professionals and Business Owners

2. Hyper Funding Your Personal Banking System (Proprietary)

3. Unlocking Financial Freedom: How Infinite Banking Can Revolutionize Your Business and Personal Wealth

4. Overfunded Whole Life: All the benefits of Overfunded Whole Life in one place

Most Americans don't realize that a tax free retirement is possible. We help individuals discover tax free strategies, and help determine which strategy is your best fit.