Overfunded Benefits

A specially designed type of Life Insurance Contract

Overfunding: The Cheat Code

Traditional financial planning treats Whole Life Insurance as a tool to get the most death benefit at the lowest cost, but that’s a narrow view. When structured intentionally and with purpose, Overfunded Whole Life insurance (OWL) can do far more.

Overfunding flips the script. It prioritizes the living benefits, steady growth, liquidity and control over the death benefit. It’s a strategy for people who want their money working for them now, not just after they're gone.

Set up the right way, whole life insurance becomes a financial cornerstone. It grows predictably over time, protects your wealth, and gives you access to capital on your terms. It’s not just life insurance. It’s a powerful asset you can use while you're alive.

The following features are all present in a properly funded, max-funded, whole life contract. Not all may be important to you, but you don't have to choose, you get them all. One will probably stand out to you now because of the stage of life you are in. The beauty of a properly built overfunded whole life (OWL) is the fact that as life changes all these benefits are ready to do the job.

If you are 10+ years away from retirement, the buffer benefit is not that important now, but the uninterrupted compounding and collateralized loan feature would be. As you start drawing on retirement funds, you'll be thankful you have this buffer asset. When you're figuring your tax bill and none of the distributions from this asset are reportable anywhere on any tax form, you'll really love that.

Bottom line, it will protect you and give you advantages throughout life that no other financial vehicle can provide. So let's look at these benefits and features.

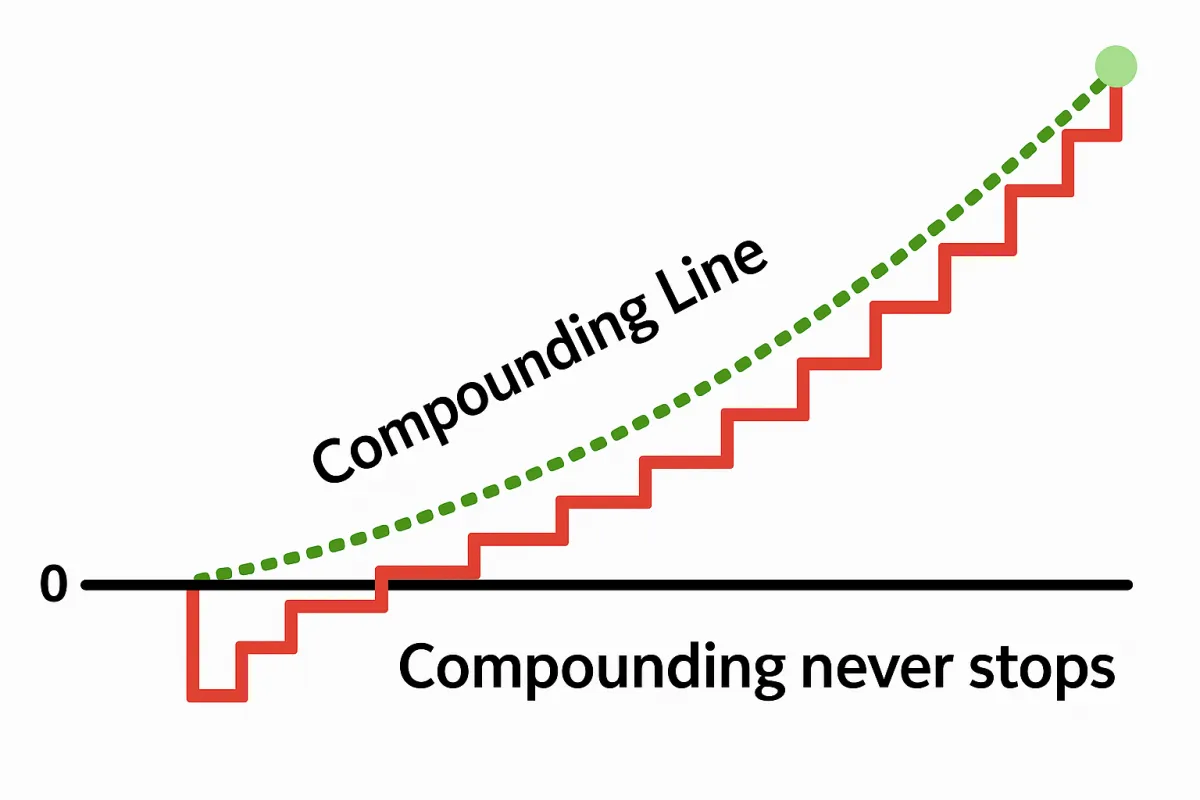

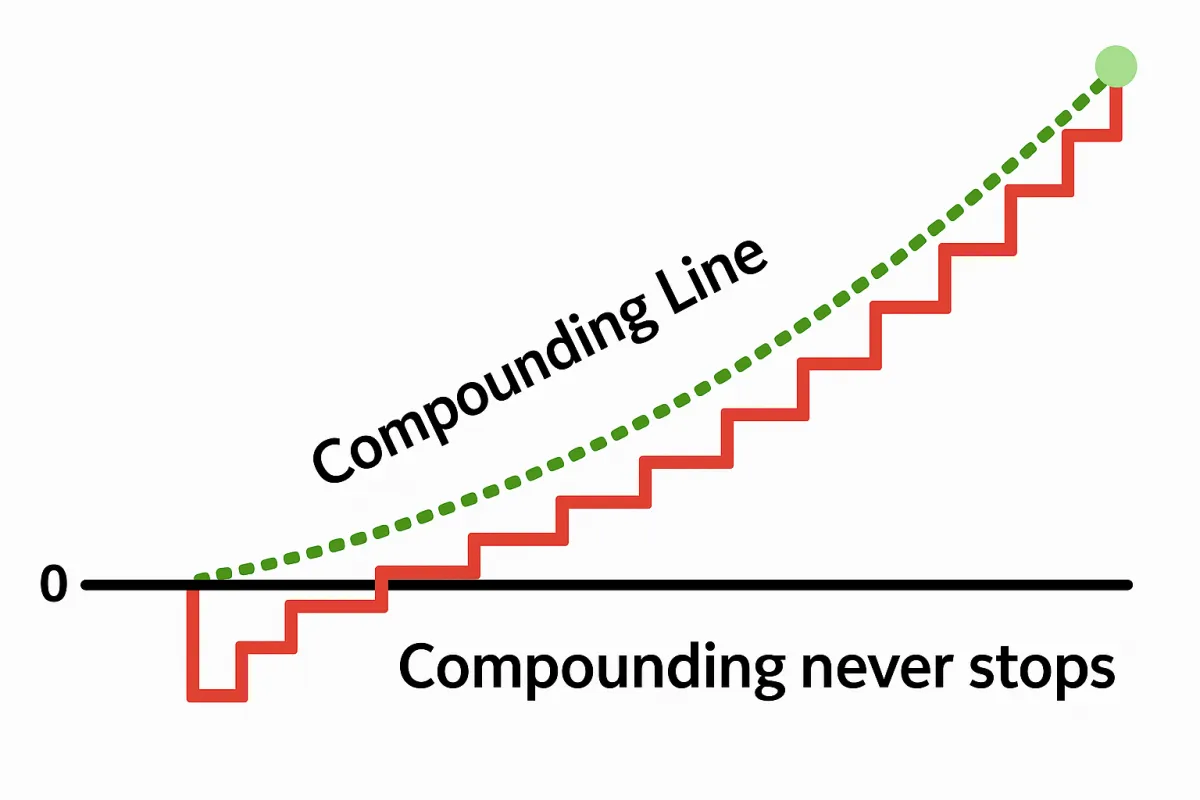

Uninterrupted Compounding

Most investments lose upward momentum over time, stopped by what we call the Four Compound Killers: taxes, fees, market volatility, and the interruption that happens when you use your capital.

OWL allows your money to grow without disruption: no taxes, no hidden fees, no market swings, and no penalty for using your capital. Your dollars keep compounding, uninterrupted, year after year.

That’s not just a feature, it’s a financial cheat code.

With this strategy, you’re not just protecting your wealth. You’re building it consistently, predictably, and with far more control. It’s one of the few assets that keeps working for you no matter what the market does.

Access Without Sacrifice

In addition to enabling uninterrupted, lifetime compounding, OWL offers a unique liquidity feature: collateralized policy loans.

This structure allows policyholders to access capital without liquidating the underlying asset or interrupting its compounding trajectory.

Unlike traditional accounts that require you to withdraw or deplete funds, this policy uses your cash value as collateral, preserving growth while providing flexible, tax-advantaged access to capital.

It functions as both a long-term wealth-building vehicle and a liquid financial tool. You gain the dual benefits of permanent life insurance and the utility of a high-yield savings alternative with none of the typical trade-offs.

Use your policy to fund opportunities, manage emergencies, or strategically deploy capital—while your money continues to work in the background, compounding year after year.

Strategic Hedge Against

Future Taxes

Ask yourself this: Do you expect taxes to go up or down in the future? If you answered up, you’re not alone and you’re likely right. With rising national debt and long-term fiscal obligations, higher taxes are not a matter of if, but when.

OWL offers a powerful way to position your money against that future:

Tax-deferred growth allows your capital to compound efficiently within the policy.

Tax-free access under IRS Code Section 7702(a) also means you can use your funds throughout your life without triggering income taxes.

Tax-free death benefit passes to your heirs without probate or income tax implications.

Contractual guarantees ensure that once your policy is in place, the tax advantages are locked in under contract protected from future changes to tax law.

Like a Roth IRA, you contribute after-tax dollars, but if structured and used properly, you’ll never pay taxes on that money again. You’re choosing to pay taxes now, potentially at lower rates, to insulate yourself from the risk of higher taxes later.

That’s not just smart—it’s strategic financial planning.

Make Your dollar Do More

OWL isn’t just a savings vehicle - it’s a multi-functional financial tool. Just like your smartphone is more than a device for calls, this policy is more than life insurance. It gives every dollar multiple jobs, working for you in several ways at once.

It’s not about choosing between growth, access, or protection—you get all three plus more.

- Guaranteed, lifetime growth that compounds steadily

- Liquidity and control, giving you access to your capital when you need it

- Future cash flow to support major goals or retirement planning

- Protection and legacy benefits, preserving wealth for the next generation

This is about optimizing every dollar, every step of the way. OWL is designed to strengthen your financial life from multiple angles, not just someday, but every day.

A Retirement Buffer

Market volatility. Sequence of returns risk. Rising taxes. These are the threats most retirees face, but few are prepared for. OWL acts as a powerful buffer, shielding your retirement plan from the unexpected and enhancing your long-term income strategy.

Outperforms traditional bonds in risk-adjusted returns and diversification, according to recent financial research

Creates a tax-advantaged stream of income that can supplement or delay tapping into market-based accounts

Protects your principal while continuing to grow, even in down markets

Gives you options, not obligations by providing flexible access to capital when you need it most

This isn’t just about retirement savings. It’s about retirement stability. OWL is designed to help you enter retirement with confidence and stay there, no matter what the market or economy does.

Protect What Matters Most

Life doesn’t always go as planned. Illness. Injury. Unexpected challenges. OWL is here for those moments, not just to grow your wealth, but to protect everything you’ve worked for and everyone you love.

Yes, it includes a death benefit. But the real strength? It shows up when life gets hard—while you’re still here.

If you’re diagnosed with a terminal illness or face a chronic condition, built-in riders let you access your benefit early so you can focus on what matters, not on money.

If you're unable to work or care for yourself, it provides financial support when you need it most.

If life throws something unexpected your way, you won’t be forced to drain your savings or make impossible choices.

This is more than a policy. It’s peace of mind. It’s protection you can count on, not just someday, but every day.

Overfunding: The Cheat Code

Traditional financial planning treats Whole Life Insurance as a tool to get the most death benefit at the lowest cost, but that’s a narrow view. When structured intentionally and with purpose, Overfunded Whole Life insurance (OWL) can do far more.

Overfunding flips the script. It prioritizes the living benefits, steady growth, liquidity and control over the death benefit. It’s a strategy for people who want their money working for them now, not just after they're gone.

Set up the right way, whole life insurance becomes a financial cornerstone. It grows predictably over time, protects your wealth, and gives you access to capital on your terms. It’s not just life insurance. It’s a powerful asset you can use while you're alive.

The following features are all present in a properly funded, max-funded, whole life contract. Not all may be important to you, but you don't have to choose, you get them all. One will probably stand out to you now because of the stage of life you are in. The beauty of a properly built overfunded whole life (OWL) is the fact that as life changes all these benefits are ready to do the job.

If you are 10+ years away from retirement, the buffer benefit is not that important now, but the uninterrupted compounding and collateralized loan feature would be. As you start drawing on retirement funds, you'll be thankful you have this buffer asset. When you're figuring your tax bill and none of the distributions from this asset are reportable anywhere on any tax form, you'll really love that.

Bottom line, it will protect you and give you advantages throughout life that no other financial vehicle can provide. So let's look at these benefits and features.

The Power of Uninterrupted Compounding

Most investments lose upward momentum over time, stopped by what we call the Four Compound Killers: taxes, fees, market volatility, and the interruption that happens when you use your capital.

OWL allows your money to grow without disruption: no taxes, no hidden fees, no market swings, and no penalty for using your capital. Your dollars keep compounding, uninterrupted, year after year.

That’s not just a feature, it’s a financial cheat code.

With this strategy, you’re not just protecting your wealth. You’re building it consistently, predictably, and with far more control. It’s one of the few assets that keeps working for you no matter what the market does.

Access Without Sacrifice

In addition to uninterrupted, lifetime compounding, OWL offers a unique liquidity feature: Collateralized Policy Loans.

This feature allows policyholders to access capital without liquidating the underlying asset or interrupting its compounding trajectory.

Unlike traditional accounts that require you to withdraw or deplete funds, this policy uses your cash value as collateral, preserving growth while providing flexible, tax-advantaged access to capital.

It functions as both a long-term wealth-building vehicle and a liquid financial tool. You gain the dual benefits of permanent life insurance and the utility of a high-yield savings alternative with none of the typical trade-offs.

Use your policy to fund opportunities, manage emergencies, or strategically deploy capital—while your money continues to work in the background, compounding year after year.

Strategic Hedge Against

Future Taxes

Ask yourself this: Do you expect taxes to go up or down in the future? If you answered up, you’re not alone and you’re likely right. With rising national debt and long-term fiscal obligations, higher taxes are not a matter of if, but when.

OWL offers a powerful way to position your money against that future:

Tax-deferred growth allows your capital to compound efficiently within the policy.

Tax-free access under IRS Code Section 7702(a) also means you can use your funds throughout your life without triggering income taxes.

Tax-free death benefit passes to your heirs without probate or income tax implications.

Contractual guarantees ensure that once your policy is in place, the tax advantages are locked in under contract protected from future changes to tax law.

Like a Roth IRA, you contribute after-tax dollars, but if structured and used properly, you’ll never pay taxes on that money again. You’re choosing to pay taxes now, potentially at lower rates, to insulate yourself from the risk of higher taxes later.

That’s not just smart—it’s strategic financial planning.

Make Your dollar Do More

OWL isn’t just a savings vehicle - it’s a multi-functional financial tool. Just like your phone is more than a device for calls, this policy is more than life insurance. It gives every dollar multiple jobs, working for you in several ways at once.

It’s not about choosing between growth, access, or protection—you get all three.

Guaranteed, lifetime growththat compounds steadily

Liquidity and control, giving you access to your capital when you need it

Future cash flow to support major goals or retirement planning

Protection and legacy benefits, preserving wealth for the next generation

This is about optimizing every dollar, every step of the way. OWL is designed to strengthen your financial life from multiple angles, not just someday, but every day.

The Retirement Buffer

Market volatility. Sequence of returns risk. Rising taxes. These are the threats most retirees face, but few are prepared for. OWL acts as a powerful buffer, shielding your retirement plan from the unexpected and enhancing your long-term income strategy.

Outperforms traditional bonds in risk-adjusted returns and diversification, according to recent financial research

Creates a tax-advantaged stream of income that can supplement or delay tapping into market-based accounts

Protects your principal while continuing to grow, even in down markets

Gives you options, not obligations by providing flexible access to capital when you need it most

This isn’t just about retirement savings. It’s about retirement stability. OWL is designed to help you enter retirement with confidence and stay there, no matter what the market or economy does.

Protect What Matters Most

Life doesn’t always go as planned. Illness. Injury. Unexpected challenges. OWL is here for those moments, not just to grow your wealth, but to protect everything you’ve worked for and everyone you love.

Yes, it includes a death benefit. But the real strength? It shows up when life gets hard—while you’re still here.

If you’re diagnosed with a terminal illness or face a chronic condition, built-in riders let you access your benefit early so you can focus on what matters, not on money.

If you're unable to work or care for yourself, it provides financial support when you need it most.

If life throws something unexpected your way, you won’t be forced to drain your savings or make impossible choices.

This is more than a policy. It’s peace of mind. It’s protection you can count on, not just someday, but every day.

Most Americans don't realize that a tax free retirement is possible. We help individuals discover tax free strategies, and help determine which strategy is your best fit.